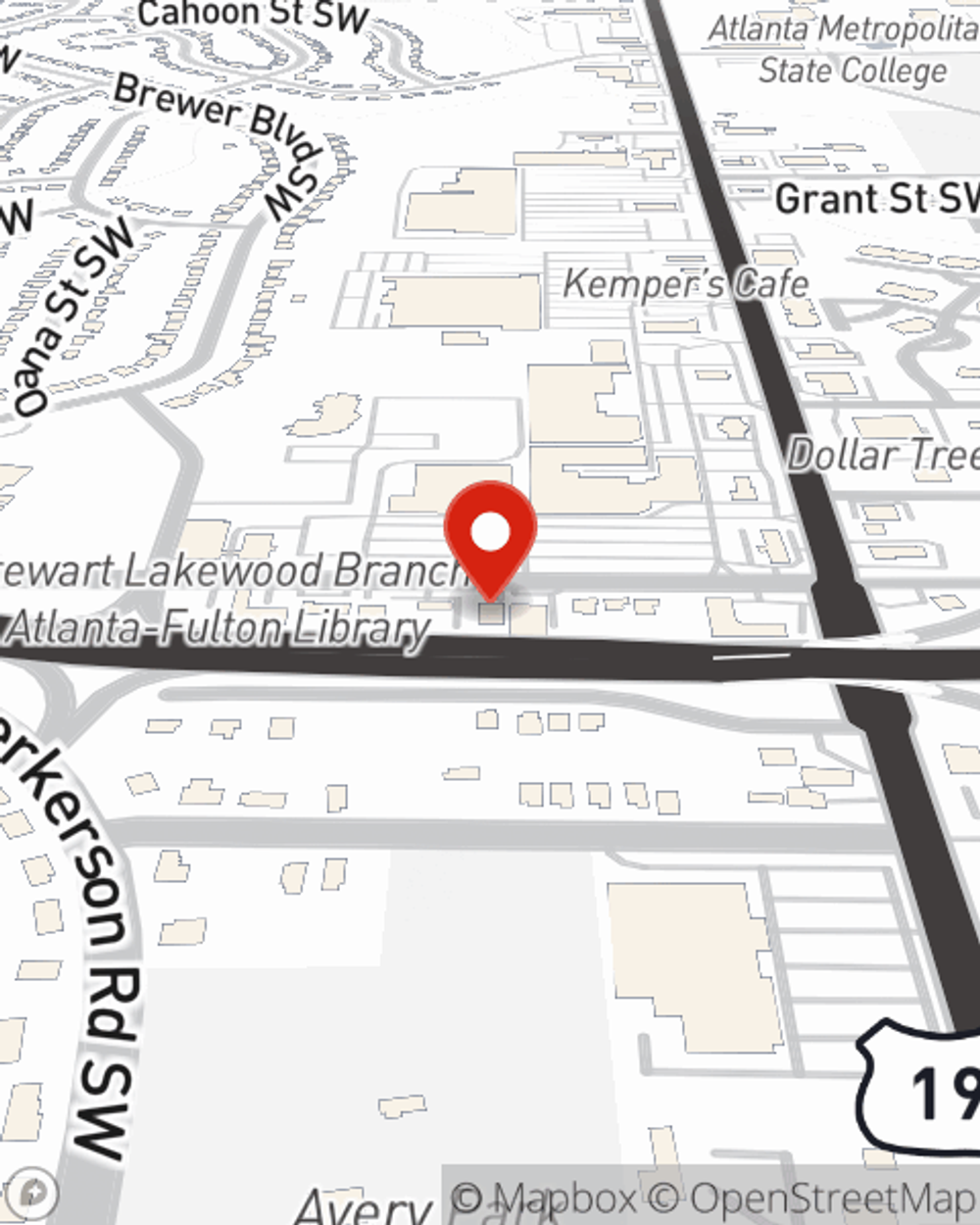

Business Insurance in and around Atlanta

Atlanta! Look no further for small business insurance.

Cover all the bases for your small business

- Atlanta

- East Point

- College Park

- Hapeville

- Fairburn

- Union City

- Fulton County

- Riverdale

- Clayton County

- Forest Park

- Jonesboro

- Morrow

Coverage With State Farm Can Help Your Small Business.

Do you feel like there's so many moving pieces and it's hard to keep it all straight when it comes to owning your small business? It can be a lot to manage! Let State Farm agent Valerie Primas help you learn about quality business insurance.

Atlanta! Look no further for small business insurance.

Cover all the bases for your small business

Insurance Designed For Small Business

That's because a small business policy from State Farm covers a wide range of concerns. Your coverage can include a business owners policy that provides for loss of income (for up to 12 months) in the event your business is closed down. It not only protects your salary, but also helps with regular payroll expenses. You can also include liability, which is important coverage protecting your company in the event of a claim or judgment against you by a visitor.

When you get a policy through the reliable name for small business insurance, your small business will thank you. Get in touch with State Farm agent Valerie Primas's team today to discover your options.

Simple Insights®

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?

How to hire employees for small business

How to hire employees for small business

Discover helpful strategies on how to hire skilled employees for your small business and learn how to attract and retain the right talent for your growing company.

Valerie Primas

State Farm® Insurance AgentSimple Insights®

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?

How to hire employees for small business

How to hire employees for small business

Discover helpful strategies on how to hire skilled employees for your small business and learn how to attract and retain the right talent for your growing company.